State Of The Industry: Economic Effects Of Fracking Felt Along

The Waterways

The Waterways Journal

20 January 2014

By David Murray

The many transformations of the American economy wrought by

hydraulic fracturing (fracking) and the resulting new abundance of

both oil and natural gas continue to affect the barge industry in

myriad ways. Mostly because of fracking, U.S. crude oil production

is on pace to match its peak year in 1970, when it reached 9.6

million barrels per day. By 2008 it stood at only 5 million

barrels per day, but by the summer of 2013 had risen back up to

7.5 million barrels per day, according to the U.S. Energy

Information Administration.

One big beneficiary from the surge in oil and gas production has

been Kirby Corporation. which continues to acquire smaller

companies and to integrate its dominant network of coastal and

inland barge routes. Throughout most of 2013. Kirby has been

reporting barge utilization rates of 90 percent or above on both

its coastal and in-land networks. Kirby's stock reached $ 100 a

share for the first time recently.

Barge-builders have also been busy. Last year opened with a

tank-barge building boom that had Walter Blessey, chairman and

chief executive officer of Blessey Marine Services Inc., publicly

worrying about overbuilding. Ken Eriksen of Informa Economics

noted in an October symposium that 200 new tank barges had brought

the total fleet to about 3.500, bringing the average age of tank

barges down to about 20 years. from 25 years just a few years ago

(WJ, October 14. 2013).

Boom Continues For Texas Port

Jennifer Stastny, director of' the Port of Victoria, Tex-as,

reports that her port, at the epicenter of the Eagle Ford shale

boom, reached its milestone of handling 2 million barrels of oil

products per day during 2013.

"We're operating at a kind of dull roar now," Stastny told The

Waterways Journal.

Having won an open bid. Devall Towing is building a barge fleeting

area at Victoria to relieve congestion along the 35-mile-long

Victoria Canal (WV, January 13). The port is adding another liquid

cargo (lock in an existing slip, and a container dock is under

construction, said Stastny.

Stastny said she has spent time persuading customers that they

could move goods cheaply to the port by container-on-barge. She

said the port will have an announcement "shortly' on the

container-barge front.

The port also does a brisk business barging frac sand. Santrol, a

subsidiary of Fairmount Minerals and a lead supplier of

"proppant" (as the drilling industry calls fracking sand) leases

warehouse space at Victoria from Equalizer; it has six rail

terminals elsewhere in Texas serving Eagle Ford customers (see

accompanying story on Equalizer, this issue).

Drilling Can Move Fast

While Victoria's near future, at least, seems assured, Richard

Brontoli, executive director of the Red River Valley Association,

points out that the drilling business can be cyclical and

volatile.

"A few years ago, our ports on the Red River were moving about a

million tons a year of sand and gravel to help prepare pads and

roads for drilling sites in the Haynesville Shale play," which is

located under east Tex-as and northern Louisiana. The oil

companies "had to move quickly to prepare the sites, because they

paid penalties if they missed deadlines," said Brontoli.

But as prices for the "dry" natural gas produced by the

Haynesville Shale play plunged. in part due to over-production,

companies temporarily closed those sites to focus on the Eagle

Ford Shale's oil and "wet" gas. which offers more revenue streams

because it is a feedstock for the chemical industry.

King Coal Dethroned

But the rising tide of fracking doesn't necessarily lift all

boats--at least, not right away. What fracking takes away, most

obviously, is coal.

For decades, coal has been the top commodity by tonnage moved on

the inland waterways. But a combination of the fracking revolution

and strict new EPA regulations on mercury emissions by power

plants have persuaded power companies to retire an accelerating

number of aging coal-fired power plants. Up until recently,

relatively few of these have been barge-served, but that is

changing.

On January 8, despite a four-month delay, the Environmental

Protection Agency (EPA) posted its New Source Performance

Standards (NSPS) rule to the Federal Register essentially

unchanged from the initial version. The American Coal Council said

the rule "will effectively remove new coal plants as an

electricity generation option, while having no direct impact on

U.S. emissions of greenhouse gases."

On January 15, the energy news service Platts reported that quotes

for coal barges loading on the Upper Mississippi and Ohio rivers

for delivery to New Orleans had dropped clue to a lack of

available tons. Platts quoted unnamed barge industry sources as

saving that offers were hovering around $15 per short ton from St.

Louis to New Orleans, and $22 from the Big Sandy River to New

Orleans. Compared with years past, the sources said, those prices

should be between $20 and $28 per short ton.

All transportation modes have been affected by the coal slowdown.

CSX railroad warned on January 16 that despite its good results

last year, weak demand for coal was masked by one-time gains due

to real-estate sales and damage payments from utilities that

didn't meet their coal commitments. CSX said ongoing weak coal

demand will make it difficult to match the company's own targets

of between 10 and 15 percent growth in earnings per share from

2013 through 2015.

Campbell Responds

Mike Monahan, president of Campbell Transportation Company,

told The Waterways Journal, "The recent closing of the Hatfield

Ferry power station is just one of a number of announced power

plant closings by several utility companies in the last year.

Unfortunately, several of the power plant closings are located in

the river system and have been served by barge operators for years

.... [Even though the Hatfield plant had] new scrubbers, ...new

EPA regulations were going to require additional capital to remain

in operation.

"The continued uncertainty of the EPA direction, and no end in

sight of raising the regulatory bar, has eliminated the ability of

utility companies to project long-term operating certainty for

coal fired power plants. The net result for the barge industry has

been the loss of a tremendous amount of coal tonnage on the inland

rivers, creating an oversupply of open hopper barge capacity."

Monahan said the changes present a "challenge to our business

model."

Diversifying and Reinventing

The privately held Campbell has responded in several ways. In

201:3, the company built its first two towboats. the Renee Lynn

and Alice jean. It has opened a barge-cleaning and

glycol-recycling facility near Congo, W.Va., and has become

involved in shipping export coal to New Orleans, a potentially

profitable business that can have sudden surges but is subject to

many uncertainties.

Campbell is downsizing its hopper barge fleet, and converting 10

percent of its open hopper barges to covered barges that can

transport other commodities like fertilizer, grain, salt, cement.

finished steel, or fracking sand. Monahan said that he hoped the

local dry bulk market around Pittsburgh would stabilize and

present some opportunities in 2014.

Campbell is not the only barge company converting hopper barges.

"It's a good time to be making barge covers." river analyst Sandor

Toth told The Waterways Journal.

Campbell already provides towing services for "a number of

companies moving liquid barges on the Ohio River system." Campbell

is also positioned with our well-developed infrastructure to

sup-port the growth in the liquids markets

and provide an m-plant cleaning and sup-port service through the

Campbell Environmental Service Company located in Congo. W.Va.,"

said Monahan. Campbell has also built a new 150-foot drydock at

Congo. with help from a small shipyard grant from the U.S.

Maritime Administration (MarAd).

The real growth prospects for Camp-bell come from fracking and its

attendant industries, said Monahan. At least four, and possibly

five, companies are in various stages of exploring opportunities

to build ethane cracker plants in the Ohio Valley region. These

multi-billion-dollar investments would generate a number of both

"upstream" and "downstream" liquid products from "wet" natural

gas, most capable of being moved by barge.

Pipeline Competition

Among the challenges barge companies will face entering the

liquids market may be competition from pipelines. The most

noteworthy of several planned projects, the Bluegrass Pipeline

project, is being developed by a partnership between Williams and

Boardwalk Pipeline Partners. In March. the partners announced that

their plan calls for a pipeline to move 200,000 barrels per day

from the Marcellus and Utica shale region to both the Gulf Coast

and the Northeast U.S.

Part of the pipeline network is already in place. while some

remains to be built. reversed. or converted from other uses. The

Bluegrass plans call for converting a section of pipeline from

Hardinsburg, Ky.. to Eunice. La.. to natural gas liquids from gas.

and building a new fractionation plant in Louisiana.

Williams and Boardwalk claim that "given current market dynamics

in the Northeast, existing liquids systems and local outlets will

be overwhelmed by 2016" by the expected volume of 1.2 mil-lion

barrels per day of natural gas liquids (NGLs).

The Bluegrass partners have said that they expect the pipeline to

be operation-al by the second half of 2015. "assuming all

necessary conditions are met." including receiving myriad state,

local and federal permits.

All Modes Overwhelmed?

But will even this additional pipe-line capacity necessarily

take business away from barges? Oil and gas output is expanding so

rapidly that all modes of transportation are benefiting. According

to the Association of American Rail-roads, U.S. Class I railroads

originated just 9,500 carloads of crude oil in 2008: by 2012. they

originated nearly 234.000 car-loads, and in 2013 the number was

closer to 600,000.

Several widely publicized rail accidents involving oil unit trains

may bring increased scrutiny to rail transportation of oil. The

most notorious derailment occurred last July 6, when a runaway oil

train exploded in the town of Lac-Mégantie, Quebec. near

Montreal. killing 47 people and putting a media spotlight on oil

transportation by rail.

The first two weeks of January alone saw two train derailments.

including one on January 7 in which a 122-car Canadian National

Railway train carrying oil and propane derailed and burned outside

of Plaster Rock, New Brunswick. forcing the evacuation of 150

people.

Fracking Water Potential

The potential of fracking-related barge work is well

illustrated by Green Hunter Resources LLC. which is taking the

lead in processing water used in fracking operations in the Ohio

Valley basin. Last March, it bought a 10.8-acre barging terminal

facility in Wheeling, W.Va.; last July, it opened a riverside

brine injection plant in Washington County, Ohio. The site opened

with a 1,200-barrels-per-day injection capacity, but will ramp up

to a capacity of more than 13,000 barrels per day.

GreenHunter is positioning itself as the industry-leading

processor of fracking-related water, of which there are three

kinds: so-called production water or fluid, naturally-occurring

water released along with oil and gas; flowback; and pit water.

According to GreenHunter president and chief executive officer

Jonathan Hoopes, the company doubled its revenues last year, from

$17 million to $34 million, and could do so again this year. Ht

announced a 10 percent dividend in its Series C Preferred shares

on January 8, and Hoopes told The Waterways Journal he is

currently raising about $35 million in investor capital for

expansion. The company is divesting sonic of its south Texas

assets to focus on Appalachia, he said.

GreenHunter is doing well even with-out barging. thanks to its

treatment wells and trucking operations. But Hoopes and

GreenHunter vice president John Jack made clear that they welcome

barging; they said the company is engaging in talks with several

barge companies, in anticipation of the Coast Guard's final

decision on barging tracking water.

Monahan said that although "Camp-bell believes hydraulic gas

drilling waste water shipments on the river will be a

cost-effective solution for shippers in the future... the actual

market size of transporting" this water "has vet to be

determined."

Right now, GreenHunter anticipates barge traffic of one or two

barges a week at its Washington County plant — to start.

LNG 'Ecosystem'

Jim McCarville, executive director of the Port of Pittsburgh

Commission, has already won kudos from the waterways community for

his innovative partner-ships that have developed the first

river-focused broadband network.

McCarville told The waterways Journal he has been in discussions

with engine makers, towboat companies, sup-pliers, and various

other groups about creating an "LNG corridor along the Ohio River,

in which towboats would in-stall LNG powered engines serviced by

terminals.

The difficulty, the said, is that all the pieces of the puzzle

have to become operational at once, since they all depend on each

other. "It's a chicken-and-egg thing,"

he said.

"You won't get boat owners installing LNG engines until they're

convinced there's an adequate support network, but engine makers

want to know there'll be a critical mass of enough boat owners

in-stalling them before they make a commitment," he said.

Regulator changes may also have to happen, with rides governing

LNG fueling docks and operation and the design of LNG-powered

vessels. Present Coast Guard rules about how LNG-powered vessels

should be designed make such vessels more expensive to build than

traditional boats.

But McCarville said new-builds alone won't be enough to convince

support players to jump into the market; retrofitting older boats

for LNG engines will have to be made economically attractive as

well.

From Tonnages To Other Metrics

No matter how successfully Campbell and other barge companies

pivot away from coal toward the new economy created by fracking,

one thing seems clear: barge tonnages will likely drop, at least

in the short term. It only takes five barrels of oil to produce

roughly the same energy output as a ton of coal. Energy-efficiency

measures and incremental improvements to the power grid also keep

energy demand from rising as fast as it otherwise might.

For decades, barge industry proponents and opponents alike have

used tonnage figures as a (rough) measure of the health of

waterways industries. Environmentalists have been known to use

declining tonnage figures on a particular river or waterway system

to argue that the barge industry is "declining" or even "dying,"

as was said of the Missouri River barge industry (luring that

liver's decade-long drought.

Getting The Figures Right

One problem with tonnage figures, according to Dennis

Wilmsmeyer, director of America's Central Port just north of St.

Louis, Mo.-- who is also currently serving as president of Inland

Rivers Ports and Terminals Inc. — is that they are often wrong.

"Some of the tonnage data collected today tends to be estimates;

and in some cases, very bad estimates of what is actually moving

on our rivers. Not only do we believe that the overall tonnage

handled on our nation's rivers is grossly under-reported, but this

under-reporting can have devastating impacts. Two years ago, the

U.S. Army Corps of Engineers proposed reducing hours of operation

at locks whose tonnage movement was below a certain threshold.

This criteria was later changed to the number of commercial

lockages, but it certainly demonstrates how errant data can cause

real-life issues," Wilmsmeyer told The Waterways journal.

Equally controversially, the Corps of Engineers in recent years

has used tonnage figures of river ports to allocate scarce

dredging resources, denying dredging for those that move less than

a million tons a year.

"The numbers [of dredge-deprived ports] are growing dramatically,"

said Wilmsmeyer. Ports are having to either pay for dredging

themselves, or turn to state and local sources. "There is a mixed

opinion on whether this is rewarding bad behavior [by the Corps]."

said Wilmsmeyer, "but the reality is that dredging may not get

done otherwise."

IRPT, along with other industry associations such as Waterways

Council. continue to lobby Congress to restore dredge funding.

Central Location Benefits Port

Wilmsmeyer port, formerly known at the Tri-City Regional Port

District, is well-positioned at the center of river, rail and road

networks, and was "relatively unscathed during the recession," he

said. Even 2012's low water benefited the port, causing "an

increase in barge traffic for offload to rail and truck" as

operators were concerned about river levels.

An economic impact study released in June 2013 estimated the

port's impact to Madison County. Ill., at 8282 million a year an

increase of 36 percent from its impact in 2007. With 75 industrial

and commercial tenants. the port loads or unloads 2.500 barges

each year and passes 2.5 million tons of commodities valued at

$1.1 billion each year.

A master plan prepared by the port in 2010 identified 11 landside

and 11 water-side projects; Wilmsmeyer said the port is "ahead of

schedule" and expects to complete the largest and most ambitious

project, the South Harbor expansion, by the fall of this year.

"2014 will be a big year for America's Central Port," said

Wilmsmeyer. "With new leases and facilities, it could be our best

year ever in terms of revenue...

New Study, New Metrics

Tonnage figures will continue to be collected and used, but

both McCarville and Wilmsmever believe the barge industry has to

stop thinking in terms of tonnage alone, and to start thinking

(and presenting itself) instead in terms of the economic impact

and reach of water-ways industries. especially in the number of

jobs it supports. McCarville believes that the "spinoff' effects

of oil and natural gas movement and processing may have more of an

economic impact than those of coal. Among other indicators of

economic vitality, new barges and vessels continue to be built at

a lively clip. IRPT is pushing for a Nationwide Inland Rivers

Economic Impact Study to gauge the true value the river system has

on this country, using many metrics.

"A study such as this has not been clone for a very long time and

would be used by nearly every port in the country to promote the

use of the rivers," said WiImsmeyer.

Jim Kruse, director of the Center for Ports and Waterways at the

Texas Transportation Institute, suggests one striking metric:

"Barges move 16 percent of America's freight for 3 percent of its

freight bill," he told The Waterways Journal.

"But apart from the savings that continue to make barge

transportation so at-tractive. we simply can't do without it

because the other surface transportation modes can't take up the

slack," were the barge industry to disappear. Kruse said.

Benteler Steel Plant

Despite Corps dredging cutbacks and Congress' failure so far to

adequate inland infrastructure maintenance, river locations

continue to attract new investment. Port directors on the Red

River system have welcomed several major new projects in recent

months.

In September, construction began on a 5975 million barge-served

steel tube manufacturing plant in Caddo Parish. La., at the Port

of Caddo-Bossier, that, when finished in August 2015, is expected

to generate 675 jobs with an average salary of $50.000.

The plant, which will serve the needs of the expanding drilling

industry, is the first manufacturing facility to be built in North

America by Benteler Steel/Tube. a subsidiary of a global steel

company headquartered in Austria with 30,000 employees in 170

plants, locations, and warehouses in 38 countries.

At the groundbreaking, Louisiana Gov. Bobby Jindal credited the

Red River Waterways commission and the Port of Caddo-Bossier with

helping to bring the plant to Louisiana. The construction work

will employ about a thousand workers. Benteler says construction

is on track to be completed in late 2014, with manufacturing

operations beginning in the second half of 2015.

Bio-Refineries Launch In Louisiana

In January, construction began at the Port of Alexandria, La.,

on the first of three bio-refineries to be built in Louisiana by

Cool Planet Energy Systems, for a total investment of $168

million. The second plant will he located at Natchitoches, and the

third at "a site to be determined." The Natchitoches plant will

begin construction in the summer of 201.5, with an estimated

completion date in summer 2016.

Using a proprietary process called the carbon-negative fuel cycle,

the plants will make high-octane, low-vapor pressure gasoline from

wood waste and forest products for barging to blending facilities

at Louisiana refineries, after which the company says the fuel

will be usable for vehicles. Feedstocks can include wood chips,

grains stubble. dead trees that have been killed by pests, corn

cobs, sugar-cane, or switchgrass.

Each plant's output will be about one-hundredth that of typical

refineries, but the plants can be located close to biomass

sources, the company said, enabling them to produce gasoline for

the target $50 a barrel, competitive with traditional refineries.

The plants will also market biochar, a refining by-product that

farmers use in the soil to reduce carbon loss from crops and to

increase water retention.

Cool Planet, headquartered in Greenwood Village, Colo., describes

itself as "deploying disruptive technology through

capital-efficient, small-scale bio-refineries to economically

convert nonfood biomass into high-octane gasoline, jet fuel, and

diesel fuel." The company's backers include Google Ventures,

Energy Technology Ventures, North Bridge Venture Partners, and a

division of Exelon. Its business model calls (or it to build 400

micro-refineries across the U.S. over the next 10 years.

Cool Planet's bio-refineries will be well-positioned to take

advantage of' a biomass-based diesel-use mandate under the

Renewable Fuel Standard of' the Energy Independence and Security

Act of 2007, which rose to 1 billion gallons for 2012 and is

assumed to remain at that level for subsequent years. Some

biodiesel production above this mandate is assumed to meet a

portion of the advanced biofuel mandate of the Renewable Fuel

Standard.

Challenges For Red River

Despite all the positive news. Brontoli said the J.

Bennett Johnston Waterway faces several challenges. Dredging "is a

challenge since we are reduced in dredging funds," he said.

"We were able to get supplemental funds two years ago, which

helped us get through this present fiscal year. Mother Nature has

also cooperated, and we have not had high-water events on the Red

River in the past year to deposit silt in the pools. The

Mississippi River has also remained high enough to keep drafts

greater than nine feet below Lock 1."

Another threat ignored except by local meddia is the rapid spread

of an aquatic fern pest, giant salvinia. Most national media

attention on aquatic threats goes to the possibility of Asian carp

migrating from the Mississippi River system to the Great Lakes, on

which the Corps of Engineers

just released a final report (WJ, January 11).

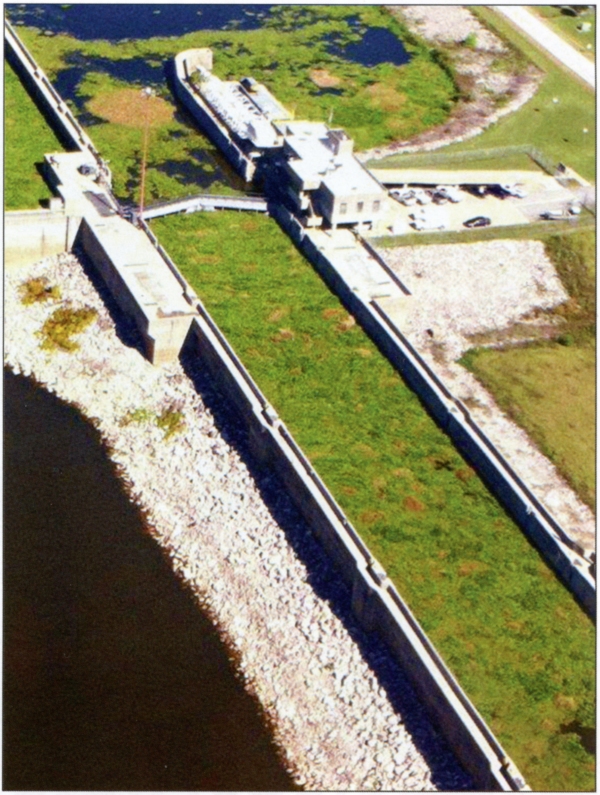

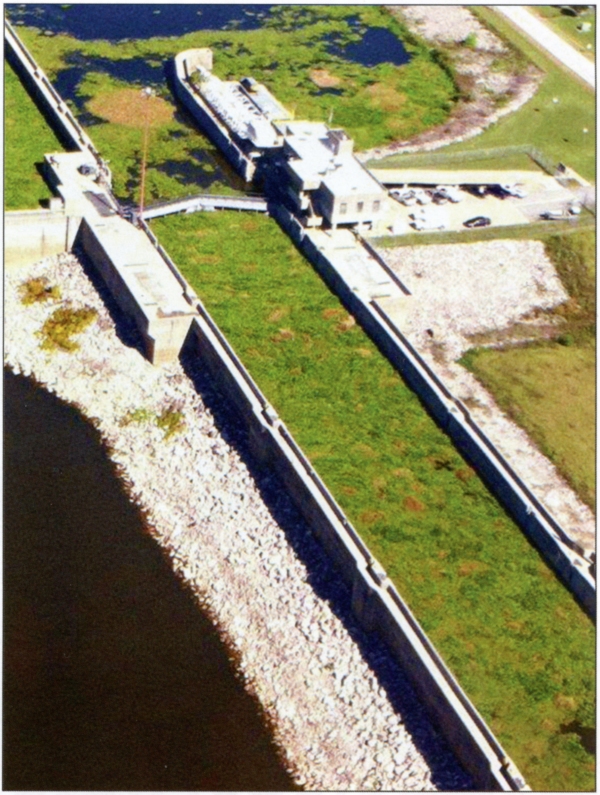

Giant salvinia in a lock

on the Red River

A Brazilian import, giant salvinia was first found in Caddo Lake

in 2006; it is now "becoming a major challenge for navigation and

recreation," Brontoli told The Waterways Journal. If conditions

are right, the plant pest can grow from a two-leaf sprig to a

40-square-mile mat in three months.

One solution employed by ports has been to import from Brazil and

release one of giant salvinia's natural predators, a weevil that

eats its leaves. Red River officials have also used mechanical

removal and spraying with herbicides to reduce infestations.

Silicon Plant Breaks Ground

On the Tennessee "Tombigbee system, the big news so far in 2014

was the groundbreaking on January 13 of a 8200 million

barge-served industrial silicon metal plant at Burnsville, Miss.,

100 miles southeast of Memphis, Tenn., and close to the Northeast

Mississippi Waterfront Industrial Park.

The Mississippi Silicon plant will pro-duce silicon metal for the

aluminum, automotive and chemical industries in the U.S. and

Canada, with some product possibly going to Japan or South Korea,

ac-cording to company officials. Mississippi Silicon is a

strategic partnership between Rima Holdings USA, Inc., and

domestic investor group Clean Tech I, LLC.

The project had previously been pro-posed for neighboring Lowndes

County, but stalled due to what Mississippi Silicon chairman of

the board John Correnti de-scribed to local media as "unreasonable

demands" by county officials. Richard Vicintin, Rina's chief

executive officer, revived the project. Vincintin had been looking

all over the world for a place to build the plant, but Mississippi

officials, including Gov. Phil Bryant, persuaded the company to

locate the plant in Tishomingo County.

The state provided a total of $21.5 mil-lion for construction and

workforce training, according to the Northeast Mississippi News,

and Tishomingo County kicked in a $3.5 million infrastructure

loan. Bryant's office told local media that Mississippi has seen

81 billion in new investment in the state during 2013, and the

creation of 6,265 new jobs, compared to $455.5 million in new

investment and the creation of 2,664 new jobs during the previous

year.

When the 100-acre plant opens some-time between 18 months and two

years from now, it is expected to provide about 200 jobs with

average salaries of $55,000 each. It will use coal, wood chips and

quartz chips as feedstocks for its two furnaces.

Tenn-Tom Growth

Bruce Windham, administrator of the Tenn-Tom Development

Authority, told The Waterways journal that traffic and tonnage on

the Tenn-Tom system has "gone up steadily over the past several

years, due mostly to steel and chemical products." Tonnages of

forest products, including wood pellets exported to north-ern

Europe, have declined somewhat, he said.

While Windham welcomes the uptick in overall tonnage, he agrees

that tonnage alone doesn't tell the whole waterways story.

Eugene Bishop, executive director of the Yellow Creek State Inland

Port Authority at Inka, Miss., notes that several of his port's

tenants move heavy-lift, high-value cargoes whose value cannot be

captured by tonnage alone.

Iuka's waterfront has attracted several steel-fabricating plants

in recent years. PSP Monotech, which makes large components for

power plants, expanded its Iuka property in 2006. G&G Steel

opened a facility in the port in 2007; it makes some of the

world's largest fabricated metal components for industrial and

infrastructure-related projects, including bridges, locks and

mining equipment, virtually all of which must move by barge.

"Oversized products really can't be shipped economically any other

way," Windham notes.

In 2012, Contract Fabricators Inc. moved into the

97,280-square-foot facility at Yellow Creek formerly occupied by

Dynasteel. CFI manufactures large pressure vessels for oil

refineries, power plants, and chemical plants, as well as heat

exchangers, stripping columns, cyclones, dryers, and other large

equipment.

Shepherding WRRDA

While ports develop and the market moves forward, the barge

industry continues to wait on developments in Washington. Shortly

before press time, the omnibus funding bill called the

Consolidated Appropriations Act of 2014 was released by House and

Senate leaders. WCI said it was "pleased" with the bill's

waterways provisions, noting that it "significantly increases

spending for critical port and navigation channel improvements,

with $1 billion provided from the Harbor Maintenance Trust Fund."

The 81.012 trillion bill includes a 8748 million increase in

waterways spending from the FY 2013 .post-sequester enacted level.

Despite last year's encouraging passage of the Water Resources

Reform & Development Act versions in both houses of Congress,

it is not not signed into law. The American Waterways Operators'

top legislative priority this year is, of course, to continue to

shepherd WRRDA through the conference committee and to the

president's desk, working closely with the WCI and other advocacy

groups.

Craig Montesano, director of legislative affairs at AWO, told The

Waterways Journal that while a "quick finish" in January and exit

of WRRDA from the conference committee that resolves differences

between the House and Senate versions of the bill is not as likely

as was once hoped, he remains optimistic about its passage.

"There are differences on language that remain to be worked out,"

he said, but these are not ideological; the spirit of

bipartisanship that marked its overwhelming vote or passage in the

House last year continues to prevail.

Montesano is also optimistic about the Coast Guard's

policy on barge transportation of fracking wastewater, which he

says AWO is following closely as the Coast Guard collects comments

to prepare for its final version.

Vessel Discharge Bill

After WRRDA, AWO's next top priority is a new hill that would

establish uniform national standards for vessel discharges to

replace the patchwork of requirements from the states. The two key

senators here are Mark Begich (D-Alaska) and Marco Rubio (R-Fla.),

who are expected to introduce the new bill "soon, according to

Montesano. "We feel more optimistic about this issue now than we

did in 2012," he said.

Rubio has a seat on the powerful Committee on Commerce, Science,

and Transportation, as well as on two of its important maritime

subcommittees, the Subcommittee on Oceans, Atmosphere, Fisheries,

and Coast Guard, and the Subcommittee on Surface Transportation

and Merchant Marine lnfrastructure, Safety, and Security.

Apart from specific legislative goals, Montesano said the AWO will

continue to reach out to relatively new legislators, perhaps two

thirds of whom have been elected to Congress since the last

passage of a WHOA in 2007. Montesano agreed that it's common for

the barge industry's friends and enemies alike to use tonnages as

a measure of the industry's health.

"We have a good story to tell. because our industry has been a

reliable job-creating engine for decades." he said.

Ann McCulloch, director-public affairs and communications for AWO,

adds, "This is a dynamic industry that is making many positive

impacts and actively preparing for its future. We would agree that

tonnage is only one measure of how to examine the industry — many

factors come into play. We think it is best to take a holistic.

approach that encomopasses not only tonnage, but employment and

revenue generated as well as industry investment in new vessels

and technologies."